Did you know that over 70% of family businesses in Nigeria fail to survive the second generation?

Imagine a thriving family business, built over decades, with siblings, cousins, and children all playing active roles. For years, the business flourished, but after the founder passed away, the question of leadership quickly became a source of conflict.

The late founder’s will named his son as heir, but the founder’s brothers, who were more experienced and deeply involved in daily operations, felt sidelined. The son, on the other hand, believed he had an unquestionable right to lead, despite his limited engagement in the company’s affairs.

What happens next is predictable: disputes, fractured relationships and in some cases, the decline of the very business that once united and provided for the family.

This scenario is familiar across Nigerian family businesses, as they often struggle to survive transitions from one generation to the next. The difficulty is rarely caused by market forces. More often, it stems from the absence of governance failures, evident in the absence of clear structures and processes to balance family and business interests. ,

What makes this even more pressing is that many next-generation heirs are highly educated, often Ivy League or globally trained, and eager to build careers. Yet, they don’t see their parents’ enterprises as “serious businesses.” Ironically, while they compete for internships in multinational conglomerates, many of which are also family-owned abroad, they hesitate to work in their own family companies. The reason is simple: a lack of structure, independence, and professionalism makes the business appear outdated. For these heirs, perception is reality, and without governance, the family business feels like a relic of the past rather than a platform for the future.

And that is the tragedy: what should be their inheritance becomes something they run from, not towards.

Governance in this context refers to the framework of rules, practices and processes that provides the clarity needed for balancing both family and corporate interests.

What Happens When Governance Is Neglected

Many families believe that loyalty and shared bloodlines are enough to keep the business united. Others shy away from difficult conversations about leadership, ownership, and responsibilities, fearing conflict or strained family ties. While understandable, this reluctance leaves the business vulnerable in ways that can quickly undermine its success.

Common consequences of weak governance include:

- Unclear succession: Power struggles erupt when founders step back or pass on.

- Undefined roles: Overlapping responsibilities fragment decision-making and slow growth.

- Ownership and dividend disputes: Avoided initially, these conflicts eventually surface, often more damaging than if addressed early.

- Lack of external accountability: Insularity weakens judgment and limits access to partnerships or financing.

- Unprepared heirs: Inheriting leadership without the skills or guidance to sustain growth.

What Changes When Governance Is Taken Seriously

Investing in governance transforms both the business and the family. Strong governance:

- Clarifies who leads, who owns, and who decides.

- Preserves unity by addressing sensitive issues proactively.

- Builds confidence among external stakeholders through transparency and accountability.

- Empowers the next generation with guidance, not guesswork.

- Strengthens long-term strategy by separating day-to-day management from vision.

- Protects the founder’s legacy by establishing a framework for continuity.

Essentials Every Family Business Needs

The benefits of governance are clear, but these outcomes do not happen on their own. They come from putting in place certain structures and practices that keep both the family and the business aligned, some of which include:

- A Functional Board: Even in small businesses, a board helps separate ownership from management, ensures decisions are reviewed rather than made in isolation, and brings transparency into how the business is run. Boards with non-family members add even greater value, offering objectivity and reducing the weight of family politics.

- A Succession Plan: Without clear planning, transitions become messy and emotional. Succession is simply not about naming an heir, but about preparing them to lead, through mentoring, responsibility-sharing and long-term development.

- A Proper Structure: Processes and systems give order to the business and take the guesswork out of daily operations. With structure, nothing is random. Anyone who steps into a role, whether a family member or not, knows exactly what is expected. Job descriptions are job descriptions, not suggestions, and performance is measured the same way for son, daughter, friend, or outsider. This consistency makes it easier for people to fit in, reduces room for favouritism, and signals that the business is run professionally.

- Defined Roles for Family Members: When responsibilities are unclear, relationships strain. Job descriptions, performance expectations and reporting lines bring professionalism and help preserve family unity.

- Proper Documentation: Often captured in constitutions, charters or other similar documents, such set expectations on employment, ownership and conduct. They replace assumptions with clarity and reduce the risk of overblown disputes by setting expectations early and entrenching enforceable mechanisms for dispute resolution and escalation.

Governance for family businesses is more than a legal formality. It is a leadership discipline that transforms good businesses into lasting legacies.

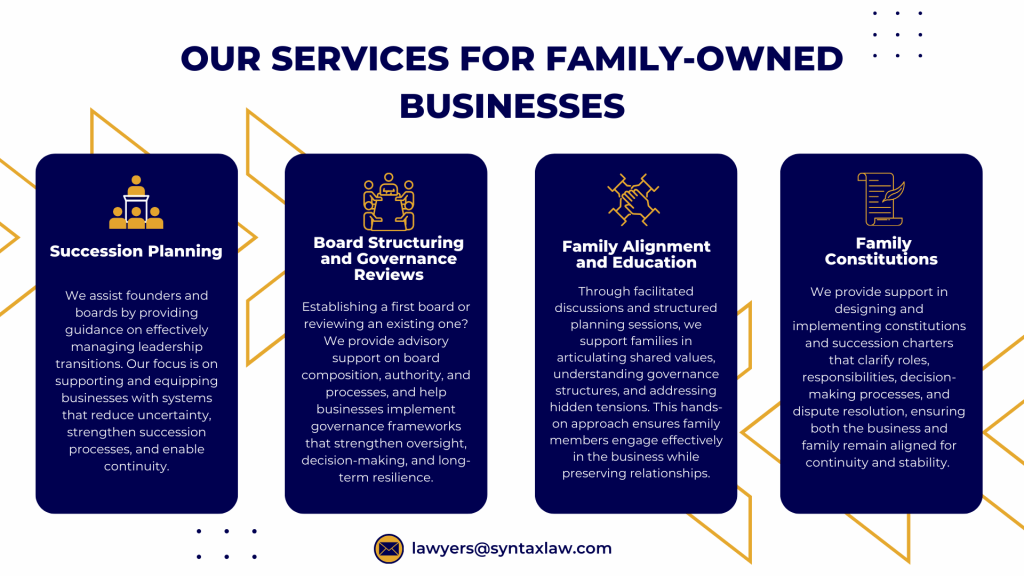

How We Support Your Legacy

At Syntax Legal Practitioners, we work with family businesses across Nigeria to support long-term stability and succession. Our support goes far beyond drafting paperwork. We advise on structures, assist with leadership development, facilitate difficult but necessary conversations, and help align business strategy with family values.

If you’re thinking about what comes next for your business, let’s start the conversation on how to make that future secured, unified, and sustainable.

Send us an email at lawyers@syntaxlaw.com