Raising capital is one of the most defining decisions for a startup founder. But beyond finding investors, the structure of the fundraising matters just as much as the money itself. The wrong instrument can create governance headaches, distort ownership, or even scare off future investors.

For Nigerian startups, several types of tools dominate early-stage fundraising conversations, with the three most common ones being: SAFEs (Simple Agreements for Future Equity), Convertible Notes, and Equity Financing. Each comes with its own advantages, risks, and governance implications.

1. SAFEs:

A SAFE is a contract where investors provide cash today in exchange for the right to receive equity in the future, usually at the next priced funding round. Unlike debt, it is simple, founder friendly, and provides more flexibility as it has no interest rate, no maturity date, and no repayment obligation.

Pros:

- Very quick and cheap to set up.

- Avoids the difficult debate about valuation at an early stage.

Cons:

- Uncertainty for investors (may never get equity if no priced round happens).

- Can stack up in messy ways if multiple SAFEs are issued with different terms.

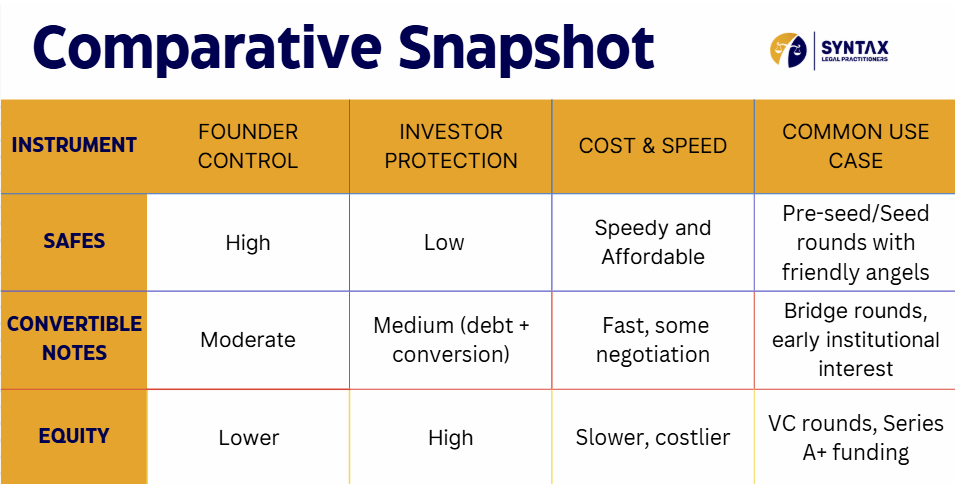

SAFEs often give investors little to no governance rights until they convert. This is great for founders in the short term but can leave investors uneasy. Nigerian investors are still getting comfortable with SAFEs, so adoption may be uneven.

2. Convertible Notes:

A Convertible Note is technically a loan that converts into equity at a later date (usually the next funding round). It comes with interest, maturity dates, and sometimes repayment obligations.

Pros:

- Attractive to investors who want downside protection (since it starts as debt).

- Offers a compromise between immediate equity and a flexible valuation.

- Common in bridging rounds or when investors want more security.

Cons:

- The debt feature creates risk for startups if conversion never happens.

- Negotiating interest and maturity can drag out discussions.

- If maturity is reached, the startup could face repayment pressure.

Convertible Notes are slightly more investor-friendly, especially with default rights. Investors may not have board seats yet, but they hold leverage through repayment terms. A convertible note is debt first and while some say it is debt disguised as equity, it is indeed equity disguised as debt. This is because conversion and not repayment is the default expectation.

If you are considering a SAFE, do not be fooled by the ‘note’ and ‘loan’ language. It’s ultimately equity, and you’ll dilute ownership just the same.

3. Equity Financing: Equity financing simply means issuing actual shares at a set valuation. Investors get immediate ownership, rights, protections and any other benefits negotiated and documented in relevant agreements.

Pros:

- Clear and permanent: investors know exactly what they own.

- Provides strong governance structures (board seats, voting rights, information rights).

Cons:

- Requires setting a valuation early, which can be tricky for young startups.

- Costlier and more time-consuming to document.

Equity is the strongest form of investor protection. Issues such as board representation, voting power, veto rights, and more are much clearer here, than under the other options provided above. While this boosts investor confidence, it reduces founder control, and there are different schools of thought on whether or not this can be considered a disadvantage.

Your Choice

There is no one-size-fits-all. The following considerations tend to guide choices for startups:

- Stage of your startup: very early stage may favor SAFEs; later stages may push towards equity.

- Investor profile: angel investors may be comfortable with SAFEs, while institutional investors prefer equity.

- Urgency and cost: SAFEs and Notes are quicker and cheaper than full equity rounds.

- Governance needs: do you want to keep investors hands-off now, or bring them into decision-making immediately?

In Conclusion

Fundraising is about a lot more than securing cash. You must properly structure long-term relationships with your investors. All the different instruments above each have their place in the startup journey and your choice must align with your specific position and not what others are doing, always finding a way to balance growth, governance, and control.

In all that you do, get legal advice before you sign anything.

Have questions or want a free consultation? Send us an email via lawyers@syntaxlaw.com